ADCAIJ: Advances in Distributed Computing and Artificial Intelligence Journal

Regular Issue, Vol. 11 N. 4 (2022), 451-474

eISSN: 2255-2863

DOI: https://doi.org/10.14201/adcaij.28395

Factors of Blockchain Adoption for FinTech Sector: An Interpretive Structural Modelling Approach

Somya Guptaa and Ganesh Prasad Sahub

a School of Management Studies, Motilal Nehru National Institute of Technology Allahabad, India

b School of Management Studies, Motilal Nehru National Institute of Technology Allahabad, India

15somyagupta@gmail.com, gsahu@mnnit.ac.in

ABSTRACT

Blockchain Technology (BT) is rapidly becoming one of the most promising emerging economy innovations. Financial Technology (FinTech) has been disrupted by blockchain, and its market size is growing by the day. FinTech is closely associated to banking, and blockchain has become very famous in the banking industry. This study aims to analyse the factors influencing behavioural intention to adopt blockchain in FinTech. A total of 13 factors were extracted from the literature, and later relations among these variables were analysed using Interpretive Structural Modelling (ISM). The study's conceptual model was built and validated by academic experts working in blockchain. Later, MICMAC analysis was performed to study these variables' driving and dependence power. Although blockchain has various challenges, its implementation is recommended in FinTech due to the advantages it offers. As per our results, the implementation of blockchain in FinTech is required as it promotes data privacy and traceability and involves more trust than traditional means.

KEYWORDS

blockchain; payment systems; FinTech, Interpretive Structural Modelling (ISM); MICMAC

1. Introduction

Several prominent financial organisations have organised research teams to look into the suitability of blockchain technology for the finance and banking industries. According to a World Economic Forum (WEF) report 2016, more than "$1.4 billion has been invested in this technology in the recent past to explore and implement its use in the financial services industry" (Clauson et al., 2018). The State Bank of India (SBI), India's largest government-controlled institution, is experimenting with blockchain-enabled smart contracts in a beta launch. This endeavour is supported by 27 banks who have grouped to investigate and develop blockchain-based banking solutions.

Currently, the financial services sector is adopting cutting edge technology. To service their business, these financial institutions will need to operate at a lower cost, with high volume payment lines, while also catering to the growing need for security and mobility. Institutional counterparties and financial service regulators are increasingly raising the demands for efficiency and transparency in business and technological processes. Over the past few years, digitalisation and cyber security have attracted investments from various banks and financial institutions, building test-to-scale approaches in trade finance, banking, and know your customer (KYC). The banking system is one of the key drivers of any country's economy, which helps mobilise resources and disburse cash in various spheres (Crookes and Conway, 2018; Guo and Liang, 2016). The banking system provides financial services such as exchanging deposits, providing multiple types of loans, etc.

On the other hand, the revenue collection system allows the government to manage its finances and provide its citizens with effective public services that foster economic growth. These systems are immensely affected by fraud and forgery, with critical cases. There is a need to secure the high-stake information resources that come with banking and e-governance systems; a part of national infrastructure that may be a target of intensive professional attacks (Sawant, 2011; Mills et al., 2016). It can eradicate and uproot corrupt practices in financial transactions, in corporate and other government machinery.

Many researchers have contributed to secure and authorised content retrieval or tamper-free access/storage methods to offset some significant factors. One such ground-breaking technology is blockchain. Since 2009, Bitcoin has operated without a central authority, making it the most valuable cryptocurrency by market capitalisation and the most well-known embodiment of the blockchain principle. It is based on the Peer-to-Peer (P2P) model. With a market valuation of almost $800 billion, over 18 million bitcoins are presently in circulation. The unspent transaction output set can be determined using a distributed record of transactions in Bitcoin (Tapscott and Tapscott, 2017). The financial industry investigated Bitcoin as a Distributed Ledger Technology (DLT).

1.1. Distributed Ledger Technology and Blockchain Technology

Distributed Ledger Technology (DLT) can be thought of as an umbrella term to designate blockchains and other distributed ledgers that operate in decentralised distributed environments spread across multiple participants in the network. DLT allows transactions and information to be recorded on shared and synchronised ledgers across a distributed network. Blockchain is one particular type of DLT.

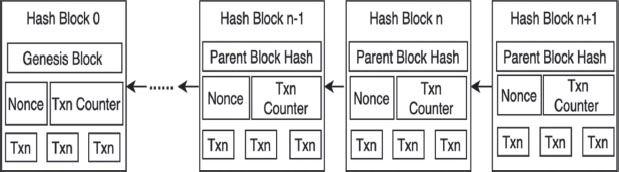

Blockchain is an append-only distributed ledger, where records are stored in hash-linked blocks, and these blocks form a chain, as shown in Figure 1 (Casino et al., 2019; Niranjanamurthy et al., 2019; Yadav and Kushwaha, 2021). It consists of characteristics, such as distributed data storage, point-to-point transmission, consensus mechanisms, and encryption algorithms (Pereira et al., 2019; Yadav, Singh, et al., 2022).

Figure 1. Blockchain consists of a continuous sequence of blocks

A block in a blockchain is a data structure that aggregates and batches multiple transactions into a suitable size on the network. It is a collection of recent and verified transactions stored in the form of a Merkle tree (Pereira et al., 2019). The first block in a blockchain is the genesis block (Pereira et al., 2019).

Blockchain, in terms of financial technology, has recently received much attention. In the finance industry, the payments sector has been through various technical upgradations and it is also one of the most crucial business areas for financial institutions. According to the Estonian government, using X-Road (a blockchain similar to middleware) and related process acceleration might save roughly 800 years of working time every year (Fridgen et al., 2018). In India, 11 big lenders launch the country's first blockchain-linked funding for Small and Medium Enterprises (SMEs) to deliver several benefits.

The potential cost savings that blockchain technology provides encourage financial institutions to take a closer look at this technology, and in some circumstances, this technology will actively promote their growth. Traditional financial technology must be redesigned in this era of increased competitiveness and security threats. To our knowledge, there has not been any research into the factors that influence blockchain adoption in FinTech in a hierarchical linkage.

The term "financial technology" can be analysed in two ways (Tapscott and Tapscott, 2017). The first dimension addresses traditional financial organisations (commercial banks, insurance companies) undertaking technological transformations. In contrast, the second aspect is the IT companies that provide innovative financial services utilising modern creative technologies which entice customers with a personalised experience through user-friendly, efficient, transparent, and automated products and services (i.e., peer to the peer lending, rob advisors, cryptocurrencies etc.). First dimension talks about modernising traditional means of finance, whereas second dimension considers FinTech companies leveraging innovative technologies for seamless delivery, personalization, agility, and relevance for customer experience.

1.2. FinTech

According to Lee and Teo (Lee and Teo, 2015), FinTech is defined through five components: less profit margins, less number assets, expandability, innovative thinking, and simple compliance. The Financial Stability Board (FSB) 2017 of the United States (US) defined FinTech as technological innovations in various economic business models, applications, processes, or products. FinTech is an important aspect of Industry 4.0 since it necessitates the use and integration of multiple technologies such as AI and Data Science and delivering a platform as a service and software as a service. FinTech has piqued the interest of practitioners, investors, regulators, and advisors and researchers interested in learning more about how this novel technology and innovations affect enterprises.

In the FinTech sector, blockchain technology provides intelligent technology solutions, applications, and new market opportunities. The current use of DLTs in finance is still very much in its infancy stage. However, the financial service industry's current business models are set to be reshaped by blockchain technology. Industry participants see an opportunity to integrate this technology into their goods and services to create organised strategies and help address current industry problems by increasing openness and enhancing behaviour. Blockchain is poised to become a mainstream technology with the ability to transform a wide range of sectors, including banking. The banking industry has begun to explore various blockchain applications in recent years. This technology is very much required in the FinTech sector.

The previous studies on blockchain and FinTech have considered various factors that led to blockchain adoption due to the advantages it offers, however, there are several barriers to blockchain adoption. (Boulos et al., 2018) described interoperability, transparency and security as blockchain adoption challenges. Whereas (Clohessy and Acton, 2019) discussed the characteristics of blockchain in both negative and positive aspects. For contrast, the authors also looked at the influence of organisational factors on blockchain adoption in organisations in a developed country. (Chang et al., 2020) described the challenges and ethical issues associated with blockchain adoption in the financial industry with interview methods. (Biswas and Gupta, 2019) discussed the characteristics of blockchain in the negative prospects, i.e., market-based risks, transaction-level uncertainties, high sustainability costs, poor economic behaviour, in the long run, privacy risk, legal and regularity uncertainties etc. Despite obstacles, blockchain is highly promising, as seen by the fact that numerous business models presently rely on decentralised finance i.e., decentralised currencies, payment systems, fundraising, lending, and contracting. Given the FinTech industry's fragmented and scattered grasp of the subject, academic study in this field is even more critical. As a result, the present study revolves around the following research questions:

Q1. What are the main inhibitors of blockchain adoption in the context of FinTech, particularly in India, and whether they are interlinked with each other?

Q2. Could it be possible to construct a framework based on the identified factors that may be utilised to increase blockchain adoption?

The purpose of this article is to thoroughly examine how blockchain technology can influence FinTech and analyse, on the basis of existing literature, various factors that lead to its adoption. This research's secondary objective is to determine the relationship between factors using literature and in-depth interviews with academic experts by adding reasoning and analysing the correlations between the discovered elements. The main objectives of this article are as follows:

1. To identify and investigate the factors that influence the adoption of blockchain technology in the FinTech industry.

2. To examine the interrelationships and interdependencies of the factors that have been determined.

3. To create a conceptual model of the factors that have been discovered.

In terms of theoretical contribution, this research analyses the contextual relationship between the variables that affect the adoption of blockchain technology in FinTech, using a systematic methodology. This study investigates the many correlations between the criteria chosen to deploy and adopt blockchain for FinTech. This study adds significantly to the present body of knowledge on blockchain and FinTech. In this study, thirteen factors have been identified that challenge the financial industry's adoption of blockchain in their business model. These discovered parameters were investigated further and used to create the ISM-MICMAC model.

The rest of the article is organised as follows. Section 2 briefs the literature in the area of blockchain and FinTech. This section also clearly explains all the factors derived from the literature. Section 3 presents the proposed ISM-MICMAC methodology with a flowchart. Section 4 represents data collection and analysis with the formulation of the research model. Section 5 explains and analyses the results and subsection 5.1 discusses the theoretical contribution. Section 6 concludes this article and defines the scope of future research, followed by subsection 6.1 on implications for practice and policy.

2. Literature Review

As of today, blockchain is representative of an agile technology, as cryptocurrencies were the original application of blockchain, however, later its application extended to other fields, such as the supply chain, e-governance, healthcare systems, delivering various financial products and services etc. Blockchain is a technological breakthrough that has gained a great deal of attention all around the globe. Blockchain technology has been most directly connected with the Bitcoin cryptocurrency, first introduced in 2008 in a white paper by Satoshi Nakamoto (Pereira et al., 2019). This technology has been described as having the ability to "shift market paradigms" (Guo and Liang, 2016), to "reverse the fortunes of the post-crisis financial sector" (Gomber et al., 2018), and to become the technology "most likely to transform the next decade of business" across all sectors (Till et al., 2017). Blockchain is a decentralised, distributed ledger that enables secure cryptocurrency transfers. Multiple and diverse groups are interested in the implementation of blockchain technology.

Blockchain cross-border transactions, explicitly correspondent banking, B2B transactions, and peer-to-peer money transfers could all benefit from blockchain. Yadav et al. proposed the blockchain framework that can reduce transaction costs and time by transmitting transactions directly from the sender to the recipient, bypassing various mediators (Yadav, Agrawal, et al., 2022; Yadav, Singh, et al., 2022). (Holotiuk et al., 2019) conducted a Delphi study on blockchain-related payment systems; on that basis, they identified how blockchain affects critical aspects of radical innovation. Whereas (Lindman et al., 2017) discussed the various issues of blockchain in payment systems. The authors focused on the organisational issues related to the competitive environment, and various technological issues. Later, they also discussed various themes within each of these areas.

In a recent article on DLT, the Bank for International Settlements' Committee on Payment and Market Infrastructures (CPMI) offered an analytical framework for investigating DLT applications in payments and settlements. Ripple is a blockchain-based payment network that focuses on commercial cross-border and inter-bank transfers. Various other blockchain platforms for payments are ABRA, which offers instant P2P money transfers without any transaction fee; another example of a blockchain-based payment system is Bitpesa. Bitpesa also provides cross-border payments to businesses and individuals between several African countries and China.

(Clohessy and Acton, 2019) used qualitative content analysis methodologies to determine the most important technology-organization-environment blockchain adoption determinants. Finally, the authors discovered three patterns: Top-level support and organisational preparation are critical facilitators for blockchain implementation. Small and medium-sized businesses are less likely to use blockchain than large corporations (SMEs) (Casino et al., 2019).

Under the title, abstract, and keywords, Scopus and Web of Science databases were searched with terms "FinTech" OR "Financial Technology" AND "Blockchain" AND "adoption." A total of 31 articles were chosen, by manually searching the relevant studies it was decided that they, matched the research's critical themes. All the factors and their possible correlations between the identified parameters were examined in the context of company performance following the acquisition of an affiliated firm based on previous studies. In this study, thirteen variables were considered. Using ISM-MICMAC approach, study create a hierarchical structure of identified factors of this study.

2.1. Factors Associated with Blockchain Adoption in FinTech

This study identified 13 variables of blockchain adoption in FinTech based on a survey of the literature. Experts were asked to rate the significance of these aspects on a Likert scale of [1–5], with "5" representing "not significant" and "1" alternatives specifying "extremely significant." All the factors, their implicit meanings, and the studies that support them are described below.

• Scalability: As the number of transactions increases, the blockchain grows more voluminous (Chang et al., 2020; Fridgen et al., 2018; Lacity, 2018; Reyna et al., 2018; Sharma et al., 2021; Yadav, Singh, et al., 2022). Blockchain transactions take longer to implement due to their complexity, encryption, and distributed nature, according to Marr (Bernard Marr, 2018a). Because all information, transactions, and balances are public, blockchain cannot prevent transactional information leakage. Visa conducts 24,000 transactions per second, PayPal 193 transactions per second, and Ethereum and Bitcoin only 20 transactions per second, according to Marr (Bernard Marr, 2018b). The reason for this is that blocks have a finite capacity, causing some small transactions to be delayed while miners prioritise transactions with high fees (Biais et al., 2019). The amount and frequency of blockchain records (or blocks) are limited, posing a scalability problem. Several blockchain adoption problems, such as scalability, were also identified in various other studies (Atlam et al., 2018; Lacity, 2018). Scalability was also cited by Reyna (Sawant, 2011) as a concern while deploying blockchain.

• Security: According to Werbach (Zheng et al., 2018), blockchain-based systems are susceptible. Blockchain is subject to collusive self-centred miners, according to (Sharma et al., 2021), and many more attacks have proved that blockchain is insecure. Bitfinex, a bitcoin exchange, hacked 120,000 bitcoins on August 2nd, 2016, resulting in a $60 million loss. Finally, in 2018, a half-billion-dollar bitcoin theft was disclosed by a Japanese exchange. Although blockchain technology has shown great practicability and innovation in e-government, supply chain management, and capital markets, authorities are still grappling with the technology's immaturity (Cong and He, 2019). The use of blockchain in FinTech may be hampered by several concerns (endpoint risks, vendor concerns, full-scale testing, untested code etc.) (Chang et al., 2020; Wamba et al., 2020; Ji and Tia, 2021; Rana et al., 2022; Toufaily et al., 2021). According to (Alketbi et al., 2018), while blockchain promises to address various security concerns, such as secure data interchange and data integrity, it also adds new security threats that must be studied and managed. According to (Sawant, 2011; Kamel Boulos et al., 2018), blockchain confronts the same issues as any other technology that threatens conventional institutions, with security and privacy being the primary concerns.

• Energy Consumption: Although blockchain is one of the most popular technologies in recent years, it consumes a tremendous amount of energy (Chang et al., 2020; Truby, 2018). Blockchain is a peer-to-peer mechanism, which means no intermediaries are involved in the transaction. It necessitates many hash calculations to achieve the best outcomes, which requires even more significant energy consumption. As a result, it is common to encounter arguments that blockchain technology's energy consumption is a concern in general (Truby, 2018). Given the current debates over climate change and sustainability, these statements may hinder or delay the broad implementation of blockchain technology (Biais et al., 2019). Big data applications can be more cost-effective in terms of execution and storage than long-term storage for electronic money transfers and transaction data (Stewart and Jürjens, 2017). The computational power required to execute blockchain is constantly rising. Based on Proof of Work consensus (PoW), the bitcoin system uses a lot of electricity, whereas Proof of Stake (PoS) is a more energy-efficient alternative to PoW. PoS is also more energy-efficient and effective. Indeed, a single bitcoin transaction necessitates a significant amount of electricity around terawatt-hour.

• Regulations & Law: With the expanding application of blockchain technology outside of cryptocurrency, regulators are paying considerably more attention to blockchain regulation to prevent fraud and other illegal behaviours that harm the interest of stakeholders and the market (Alketbi et al., 2018; Biais et al., 2019; Chang et al., 2020; Mary C. Lacity, 2018; Rana et al., 2022). The technological difficulty of blockchain is that it will never be able to guarantee the integrity of offline data, no matter how advanced the technology grows. Apart from the technical difficulties, determining which laws should be followed and which courts have the authority to decide on what matters for blockchain-related issues is a difficult and sometimes contradictory task because each node of a blockchain ledger could be in a different part of the world (Chang et al., 2020). Whereas in the case of FinTech, no clear rules or guidelines are available to control the financial transactions (Lacity, 2018), apart from the other challenges studied, management challenges, such as framed rules and regulations, are one of the major concerns for blockchain adoption.

• Traceability of Transaction: Traceability refers to the ability to determine where a product originated and follow its path through the whole transformation and distribution process (Samad et al., 2022; Shin, 2019). The specifics of every single transaction in the network can be recorded in an immutable manner due to DLT technology. These data are used to create audit trails, which authorised parties can inspect. The information provided by blockchain is trustworthy and cannot be doubted. The many users in the chain can notice flaws or threats in real-time using blockchain. One of the primary advantages of blockchain is traceability, which clarifies the benefits for people (Jonsson, 2018). Traceability and security are fundamental elements of operating blockchain systems; hence, they can be called technological affordances in blockchains (Rana et al., 2022; Shin, 2019).

• Decentralisation: Blockchain is a decentralised peer-to-peer computer network. Blockchain does not require a central control point or a single storage point because it is a decentralised system (Chang et al., 2020; Chen and Bellavitis, 2020; Ji and Tia, 2022; Kabir, 2021). Decentralisation also lowers the risk of a single point of failure. As the accounting activities are scattered over many distinct entities on the network, there is no need for a central organisation to execute smart contracts. According to (Zheng et al., 2018), each transaction in a normal centralised transaction system must be confirmed by a central trusted agent (such as the central bank). Without the need for a third party, any member of the blockchain can access the database and examine the transaction history (Till et al., 2017). The key benefit of this chain is that it has several copies of replicated data scattered across a distributed network. As a result, if a criminal or oppressive government wishes to remain undetected, they must upgrade all blockchain versions at the same time (Prasad et al., 2018).

• Privacy/ Transparency: For public blockchains, 'privacy poisoning' issues, in which recorded personal data violates privacy norms, are a problem (Biswas and Gupta, 2019; Chang et al., 2020; Rana et al., 2022; Truby, 2018). It is challenging to strike a balance between an individual's right to privacy in an open network, especially on cross-border blockchain platforms. Blockchain technology can generate perpetual and unchangeable records for stakeholders, enhancing the privacy dangers for specific entities (Toufaily et al., 2021). Meanwhile, establishing confidentiality in open blockchain-based technologies is challenging since all network participants have access to information by default (Stewart and Jürjens, 2017). Users demand privacy, but transparency is necessary to identify ownership and eliminate double-spending (Casino et al., 2019; Shin, 2019). According to (Feng et al., 2019), participants' addresses, transaction values, timestamps, and sender signatures are all included in blockchain transactions, allowing data miners to track transaction flows and extract important information.

• Leadership Readiness: One of the main CSFs, according to IBM, is top-down executive support for new blockchain use cases (Prasad et al., 2018). Technology adoption requires organisational leadership, particularly in terms of championing breakthroughs. According to (Holotiuk et al., 2019), blockchain adoption is hampered by a lack of senior management expertise. Furthermore, because blockchain promotes a new way of doing business, it necessitates leadership to delegate responsibility to various nodes, most of which are anonymous and outside their control (Prasad et al., 2018; Truby, 2018). Executive leadership must also comprehend this new technology to bring out meaningful use cases from their organisation.

• Robust & Mature Smart Contract: Nick Szabo coined the phrase "smart contract" in a 1997 paper (Kabir, 2021; Tang and Veelenturf, 2019) to describe an automated legal agreement with automatic penalties. However, it was not until the Ethereum Foundation coined the phrase in 2013 to refer to programmatic code distributed and operated on the Ethereum DLT that it became widely accepted. A building block of Distributed Apps (DApps) on Ethereum is now referred to as a "smart contract" in the DLT community. Smart contracts are implemented differently than typical software programmes. The programmatic source code that is used to build intelligent contracts is stored in the DLT's immutable data storage.

• Price Value: The cost of installing, maintaining, and securing blockchain has a detrimental influence on its adoption and use in FinTech (Gomber et al., 2018; Rana et al., 2022). The price value is the cost associated with the adoption of a particular technology (Biswas and Gupta, 2019; Mishra and Kaushik, 2021; Rana et al., 2022; Truby, 2018). More secure, agile, and cost-effective structures can be offered thanks to the blockchain network, rather than insecure and costly present solutions (BDO, 2020).

• Trust: Teubner et al., 2016, 2017 conceptualise trust as "a consumer's willingness to rely on a host's actions and intentions, which can be further separated into the trusting beliefs of ability, integrity, and benevolence" as with the initial phase of blockchain, when implemented in bitcoin there were several cases of fraud and theft. Many businesses are concerned about the cost and efficiency of blockchain (Casino et al., 2019; Liu and Ye, 2021; Mishra and Kaushik, 2021; Sharma et al., 2021; Shin, 2019). Although blockchain technology can reduce expenses, it is nevertheless limited by traditional systems. Blockchain infrastructure development and initial investment are costly (Reyna et al., 2018). Smaller financial institutions and banks may choose not to invest in this technology (Lakhani and Iansiti, 2017). The adoption of blockchain technology is also hampered by high maintenance expenses (Casino et al., 2019). Several challenges must be overcome before this technique may be implemented. Knowledge-hiding, which was observed in the early days of adoption to prevent institutions or management from succeeding, is one of the most challenging human-related issues with blockchain adoption (Chang et al., 2020).

• Immutable: Due to the immutability of blockchain, it is impossible to edit or amend transactions (Rana et al., 2022). Each block includes data, its hash, and the preceding block's hash. If someone modifies any of the blockchain's blocks, the hash will change, and subsequent blocks will fail to acknowledge the tempered block. Thus, tampering with a single block enables the observer to identify it without requiring the observer to examine each and every block. Due to blockchain's immutability, it can displace conventional financial intermediaries, and its benefits have been recognised across a range of financial industries (Chong et al., 2019; Till et al., 2017).

• Behavioural Intension: Behavioural intention has been repeatedly found to play a significant influence in determining the actual usage and acceptance of new systems in preceding IS/IT literature (Prasad et al., 2018; Rana et al., 2022; Shardeo et al., 2020). It has been investigated that the intention to use it can be considered the significant construct.

3. Methodology

In this research article, the ISM-MICMAC methodology has been used to develop theory and contribute to the literature in a realistic and context-rich manner. ISM was created by Warfield (Warfield, 1974) as an interactive learning tool that depends on expert judgement to link a phenomenon to multiple relevant factors (directly or indirectly). To describe the type and context-dependent interrelationships, ISM uses a hierarchical organisation of elements (Mathiyazhagan et al., 2013). The MICMAC approach determines a variable's driving and dependence power. The ISM-MICMAC combination has been extensively used in the literature (Agi and Nishant, 2017; Haleem et al., 2016), however, in literature on blockchain, the ISM methodology is quite limited to application on supply chain (Agi and Nishant, 2017; Rana et al., 2022; Samad et al., 2022; Sharma et al., 2021; Xu et al., 2021; Yadav and Kushwaha, 2022), but no ISM methodology applications have been found in relation to the adoption of blockchain in FinTech. The ISM-MICMAC based methodology was chosen over other exploratory research methodologies after a systematic evaluation of the literature and gaps form the literature. ISM- MICMAC was employed over other methodologies because of several advantages:

1. This systemic approach evaluates all possible pairwise correlations of system parts, whether through participant response or transitive extrapolation.

2. The reachability Matrix's use of transitive interpretation has boosted the efficiency of relational queries by 50-80%.

3. It directs and records the results of group discussions on complicated issues effectively and methodically.

4. Focusing specialists' attention on one single subject at a time improves the efficiency of multidisciplinary and interpersonal communication.

5. It is a learning tool for a better understanding of the meaning and importance of the listed factors and a well-accepted method in the literature for revealing contextual links in blockchain adoption.

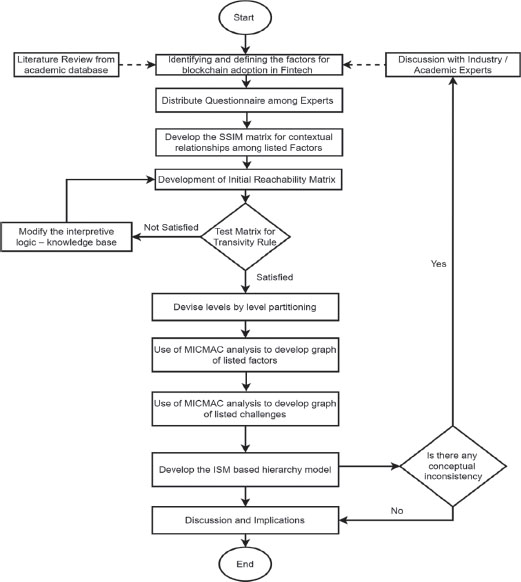

Total interpretive structural modelling is a variation of the ISM-based technique (TISM). TISM interprets both nodes and connections in the digraph, whereas ISM only interprets nodes. To provide a better explanatory framework, TISM includes several critical transitive linkages, whereas ISM does not. ISM- MICMAC based flowchart is illustrated in Figure 2. According to (Rana et al., 2022) the ISM-MICMAC approach entails:

Figure 2. Interpretive Structural Modelling Process

1. Using a literature survey and expert comments to identify the factors associated with the study topic (e.g., 13 critical factors of blockchain adoption in the FinTech sector).

2. Construct contextual linkages between factors through data collection, using paired comparisons and expert guidance, and produce a Structural Self-Interaction Matrix (SSIM) of the identified components.

3. Using SSIM to generate an initial "reachability matrix" (IRM) and then refining it with transitivity relations to generate a final "reachability matrix" (FRM) among factors.

4. Estimating each factor's driving power and dependencies by summing the data (FRM rows and columns) and establishing an FRM hierarchy using reachability and antecedent sets. The intersection set is derived by merging sets.

5. Using the computed driving powers and factors dependencies, the following stage employs the MICMAC method to generate a graph of listed factors using the added driving powers and factors relationships. Expert inputs are grounded in four unique regions (autonomous, dependent, linkage, and drivers).

6. The next step is to use the reachability and intersection data sets to develop an ISM-based structural model. The outcome ISM model can be analysed for consistency (with expert input), and necessary actions can be advised to policymakers and financial institutions service providers and practising improvement facilitators.

4. Data Collection and Analysis

Experts from the FinTech and blockchain industry who met the required qualifications provided the data. This exercise was challenging because there was a limited pool of experts with this level of in-depth expertise, particularly those with practical experience in blockchain technology. According to our requirement, experts must comprehend blockchain technology and FinTech and demonstrate neutrality by not employing a software vendor or favouring a specific solution. A panel of experts from academic institute and bank personnel from India make up the panel. These specialists worked on blockchain implementation initiatives, and experts from educational institutions have also worked on various implementation projects. The information was gathered from eight experts. These experts have previously worked on a blockchain project and conducted research. The ISM-MICMAC technique was used to analyse the data. Table 1 presents the respondents' demographic summary regarding their job title, education, years of experience.

Table 1. Demographic Information of Experts

Demographic Classification |

Category |

No. of Experts |

Job title |

Academic member |

5 |

|

Industry |

3 |

Year of Experience |

0-5 Years |

6 |

|

10-15 Years |

1 |

|

15-20 Years |

1 |

4.1. Selection of the Factors Relevant to Blockchain Adoption in FinTech

The initial literature study revealed certain factors influencing blockchain adoption in the FinTech sector, out of which the questionnaire confirmed 13 factors through expert opinion. A brainstorming session with an expert panel was held, and the challenges that hinder blockchain adoption in the public sector (from the literature and a "5" point Likert scale questionnaire) were discussed. The expert panel's subsequent debate and decision determined those factors with a rating of "3" or higher would be kept. The inclusion of the 13 literature-based determinants for blockchain adoption in FinTech was agreed upon and supported by all of the experts.

4.2. Development of SSIM, IRM and FRM

Pairwise comparisons were used to examine the collection of factors to find contextual links (direction) between them. The expert panel analysed the data from the questionnaire to identify the contextual relationship between each of the elements. Each expert was asked to score each difficulty to evaluate how closely it linked to other challenges. The relationships were coded with pre-existing symbols. "A" – when factor "i" will lead to factor "j"; (2) "B" – when factor "j" will lead to factor "i" (3) "C" – when factors "i" and "j" will facilitate each other; and (4) "D" – when factors "i" and "j" are unrelated to each other. The SSIM results are shown in Table 2, where each expert's perspective on interdependence is depicted using the required notation.

Table 2. SSIM for Critical Factors of Blockchain Adoption in FinTech

i/j |

Variables |

F13 |

F12 |

F11 |

F10 |

F9 |

F8 |

F7 |

F6 |

F5 |

F4 |

F3 |

F2 |

F1 |

F1 |

Scalability |

A |

D |

A |

A |

B |

A |

B |

C |

D |

D |

A |

D |

$ |

F2 |

Security |

A |

C |

C |

A |

B |

C |

C |

C |

C |

B |

D |

$ |

- |

F3 |

Energy Consumption |

A |

B |

D |

A |

B |

A |

D |

B |

B |

B |

$ |

- |

- |

F4 |

Regulations & Law |

A |

A |

A |

D |

C |

A |

A |

D |

A |

$ |

- |

- |

- |

F5 |

Traceability of Transactions |

A |

B |

A |

D |

A |

A |

D |

B |

$ |

- |

- |

- |

- |

F6 |

Decentralisation |

A |

A |

A |

A |

B |

A |

A |

$ |

- |

- |

- |

- |

- |

F7 |

Privacy / Transparency |

A |

C |

A |

D |

B |

A |

$ |

- |

- |

- |

- |

- |

- |

F8 |

Leadership Readiness |

A |

D |

B |

D |

B |

$ |

- |

- |

- |

- |

- |

- |

- |

F9 |

Robust and Mature Smart Contract |

A |

A |

A |

D |

$ |

- |

- |

- |

- |

- |

- |

- |

- |

F10 |

Perceived Value |

A |

D |

D |

$ |

- |

- |

- |

- |

- |

- |

- |

- |

- |

F11 |

Trust |

A |

B |

$ |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

F12 |

Immutable |

A |

$ |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

F13 |

Behavioural Intension |

$ |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Table 3. Initial Reachability Matrix for Blockchain Adoption in FinTech

i/j |

Variables |

F1 |

F2 |

F3 |

F4 |

F5 |

F6 |

F7 |

F8 |

F9 |

F10 |

F11 |

F12 |

F13 |

Driving power |

F1 |

Scalability |

1 |

0 |

1 |

0 |

0 |

1 |

0 |

1 |

0 |

1 |

1 |

0 |

1 |

7 |

F2 |

Security |

0 |

1 |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

10 |

F3 |

Energy Consumption |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

1 |

0 |

1 |

0 |

0 |

1 |

4 |

F4 |

Regulations & law |

0 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

11 |

F5 |

Traceability of Transactions |

0 |

1 |

1 |

1 |

1 |

0 |

0 |

1 |

1 |

0 |

1 |

0 |

1 |

12 |

F6 |

Decentralisation |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

1 |

11 |

F7 |

Privacy / Transparency |

1 |

1 |

0 |

0 |

0 |

0 |

1 |

1 |

0 |

0 |

1 |

1 |

1 |

7 |

F8 |

Leadership Readiness |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

1 |

3 |

F9 |

Robust and Mature Smart Contract |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

1 |

0 |

0 |

1 |

1 |

10 |

F10 |

Perceived Value |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

2 |

F11 |

Trust |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

0 |

1 |

3 |

F12 |

Immutable |

0 |

1 |

1 |

0 |

1 |

0 |

1 |

1 |

0 |

1 |

0 |

1 |

1 |

8 |

F13 |

Behavioural Intension |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

|

Dependence Power |

4 |

8 |

6 |

3 |

5 |

4 |

6 |

11 |

4 |

7 |

7 |

6 |

13 |

|

Following the specified rules, the above information in Table 2 as compiled SSIM is a reachability matrix. This is accomplished by substituting A, B, C, and D with 1 or 0, depending on the case. The SSIM is converted into the reachability matrix using the following rules illustrated in Table 3:

1. If the SSIM (i, j) entry is A, the reachability matrix (i, j) entry becomes 1 and the (j, i entry) becomes 0.

2. If the SSIM (i, j) entry is B, the reachability matrix (i, j) entry becomes 0, and then (j, i) entry becomes 1.

3. If the (i, j) entry in the SSIM is C, the (i, j) entry in the reachability matrix becomes 1 as well as the (j, i) entry also become 1.

4. If the (i, j) item in the SSIM is D, the (i, j) entry in the reachability matrix becomes 0 and even the (j, i) entry also become 0.

The application of transitivity is required for the changeover from IRM to FRM. Table 4 displays the results. The following are examples of transitivity: If A is connected to B (A → B) and B is connected to C (B → C), then A and C (A →C) have a transitive relationship. Within the FRM, transitive relationships are denoted by emphasising "1*" for each transitive relationship instance. Each challenge's driving and dependence power are computed, and a sum of the (i, j) entries within the FRM is quantified.

Table 4. Final Reachability Matrix for Blockchain Adoption in FinTech

i/j |

Variables |

F1 |

F2 |

F3 |

F4 |

F5 |

F6 |

F7 |

F8 |

F9 |

F10 |

F11 |

F12 |

F13 |

Driving power |

F1 |

Scalability |

1 |

0 |

1 |

0 |

0 |

1 |

0 |

1 |

0 |

1 |

1 |

1* |

1 |

8 |

F2 |

Security |

1* |

1 |

1* |

0 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

12 |

F3 |

Energy Consumption |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

1 |

0 |

1 |

0 |

0 |

1 |

4 |

F4 |

Regulations & Law |

1* |

1 |

1 |

1 |

1 |

1* |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

13 |

F5 |

Traceability of Transactions |

1* |

1 |

1 |

1 |

1 |

1* |

1* |

1 |

1 |

0 |

1 |

1* |

1 |

12 |

F6 |

Decentralisation |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

1 |

11 |

F7 |

Privacy / Transparency |

1 |

1 |

0 |

0 |

1* |

1* |

1 |

1 |

0 |

0 |

1 |

1 |

1 |

9 |

F8 |

Leadership Readiness |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

1 |

3 |

F9 |

Robust and Mature Smart Contract |

1 |

1 |

1 |

1 |

1* |

1 |

1 |

1 |

1 |

0 |

0 |

1 |

1 |

11 |

F10 |

Perceived Value |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

2 |

F11 |

Trust |

0 |

0 |

0 |

0 |

0 |

1* |

0 |

1 |

0 |

0 |

1 |

0 |

1 |

4 |

F12 |

Immutable |

1* |

1 |

1 |

0 |

1 |

0 |

1 |

1 |

0 |

1 |

0 |

1 |

1 |

9 |

F13 |

Behavioural Intension |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

|

Dependence Power |

8 |

8 |

8 |

3 |

7 |

8 |

7 |

11 |

4 |

7 |

7 |

8 |

13 |

99/99 |

4.3. Level Partitioning

The matrices are then split into importance levels to form a "causal" hierarchical structure. This is accomplished by applying reachability, antecedent, and intersection sets. Reachability entails analysing each factor and the other highlighted elements that could be altered. On the other hand, the antecedent is made up of the elements as well as any other variables that may affect it. The intersection set is discovered by combining the reachability and antecedent sets, which is done for all factors. The factors on level 1 were achieved when the reachability and intersection sets were equal for every factor (for example, "behavioural intension to adopt blockchain in FinTech (F13)"). The recording of a factor at any level was deleted, and the cycle was repeated until all factors were exhausted. Five iterations, illustrated in Table 5, were carried out, yielding the ISM-based factor model for blockchain adoption in the FinTech context and the importance levels.

Table 5. Level Partitioning Matrix

Element |

Reachability Set |

Antecedent Set |

Intersection Set |

Level |

(a): Iteration- 1 |

||||

F1 |

1,3,6,8,11,12,13 |

1,2,4,5,6,7,9,12 |

1,6,12 |

|

F2 |

1,2,3,5,6,7,8,9,10,11,12,13 |

2,4,5,6,7,8,9,12 |

2,5,6,7,8,9,11,12 |

|

F3 |

3,8,10,13 |

1,2,3,4,5,6,9,12 |

3 |

|

F4 |

1,2,3,4,5,6,7,8,9,10,11,12,13 |

4,5,9 |

4,5,9 |

|

F5 |

1,2,3,4,5,6,7,8,9,11,12,13 |

2, 4,5,6,7,9,12 |

2,4,5,6,7,9,12 |

|

F6 |

1,2,3,5,6,7,8,10,11,12,13 |

1,2,4,5,6,7,9,11 |

1,2,5,6,7,11 |

|

F7 |

1,2,5,6,7,8,11,12,13 |

2,4,5,6,7,9,12 |

2,5,6,7,12 |

|

F8 |

2,8,13 |

1,2,3,4,5,6,7,8,9, 11, 12 |

2,8 |

|

F9 |

1,2,3,4,5,6,7,8,9,12,13 |

2,4,5,9 |

2,4,5,9 |

|

F10 |

10,13 |

1,2,3,4,6,10,12 |

10 |

|

F11 |

6,8,11,13 |

1,2,4,5,6,7,11 |

6,11 |

|

F12 |

1,2,3,5,7,8,10,12,13 |

1,2,4,5,6,7,9,12 |

1,2,5,7,12 |

|

F13 |

13 |

1,2,3,4,5,6,7,8,9,10,11,12,13 |

13 |

Level I |

(b): Iteration- 2 |

||||

F1 |

1,3,6,8,11,12 |

1,2,4,5,6,7,9,12 |

1,6,12 |

|

F2 |

1,2,3,5,6,7,8,9,10,11,12 |

2,4,5,6,7,8,9,12 |

2,5,6,7,8,9,11,12 |

|

F3 |

3,8,10 |

1,2,3,4,5,6,9,12 |

3 |

|

F4 |

1,2,3,4,5,6,7,8,9,10,11,12 |

4,5,9 |

4,5,9 |

|

F5 |

1,2,3,4,5,6,7,8,9,11,12 |

2, 4,5,6,7,9,12 |

2,4,5,6,7,9,12 |

|

F6 |

1,2,3,5,6,7,8,10,11,12 |

1,2,4,5,6,7,9,11 |

1,2,5,6,7,11 |

|

F7 |

1,2,5,6,7,8,11,12 |

2,4,5,6,7,9,12 |

2,5,6,7,12 |

|

F8 |

2,8 |

1,2,3,4,5,6,7,8,9, 11, 12 |

2,8 |

Level II |

F9 |

1,2,3,4,5,6,7,8,9,12 |

2,4,5,9 |

2,4,5,9 |

|

F10 |

10 |

1,2,3,4,6,10,12 |

10 |

|

F11 |

6,8,11 |

1,2,4,5,6,7,11 |

6,11 |

|

F12 |

1,2,3,5,7,8,10,12 |

1,2,4,5,6,7,9,12 |

1,2,5,7,12 |

|

(d): Iteration-3 |

||||

F1 |

1,3,6,11,12 |

1,2,4,5,6,7,9,12 |

1,6,12 |

Level III |

F2 |

1,2,3,5,6,7,9,10,11,12 |

2,4,5,6,7,9,12 |

2,5,6,7,9,11,12 |

|

F3 |

3,8,10 |

1,2,3,4,5,6,9,12 |

3 |

Level III |

F4 |

1,2,3,4,5,6,7,9,10,11,12 |

4,5,9 |

4,5,9 |

|

F5 |

1,2,3,4,5,6,7,9,11,12 |

2, 4,5,6,7,9,12 |

2,4,5,6,7,9,12 |

|

F6 |

1,2,3,5,6,7,10,11,12 |

1,2,4,5,6,7,9,11 |

1,2,5,6,7,11 |

Level III |

F7 |

1,2,5,6,7,11,12 |

2,4,5,6,7,9,12 |

2,5,6,7,12 |

|

F9 |

1,2,3,4,5,6,7,9,12 |

2,4,5,9 |

2,4,5,9 |

|

F10 |

10 |

1,2,3,4,6,10,12 |

10 |

|

F11 |

6,11 |

1,2,4,5,6,7,11 |

6,11 |

|

F12 |

1,2,3,5,7,10,12 |

1,2,4,5,6,7,9,12 |

1,2,5,7,12 |

Level III |

(e): Iteration -4 |

||||

F2 |

2,5,7,9,10,11 |

2,4,5,7,9 |

2,5,7,9 |

Level IV |

F4 |

2,4,5,6,7,9,10,11 |

4,5,9 |

4,5,9 |

|

F5 |

2,4,5,7,9,11 |

2,4,5,7,9 |

2,4,57,9 |

Level IV |

F7 |

2,5,7,11 |

2,4,5,7,9 |

2,5,7 |

Level IV |

F9 |

2,4,5,7,9 |

2,4,5,9 |

2,4,5,9 |

|

F10 |

10 |

2,3,4,10 |

10 |

|

F11 |

11 |

2,4,5,7,11 |

11 |

Level IV |

(f): Iteration -5 |

||||

F4 |

4,9,10 |

4,9 |

4,9 |

Level V |

F9 |

4,9 |

4,9 |

9 |

Level V |

F10 |

10 |

4,10 |

10 |

Level V |

4.4. MICMAC Analysis

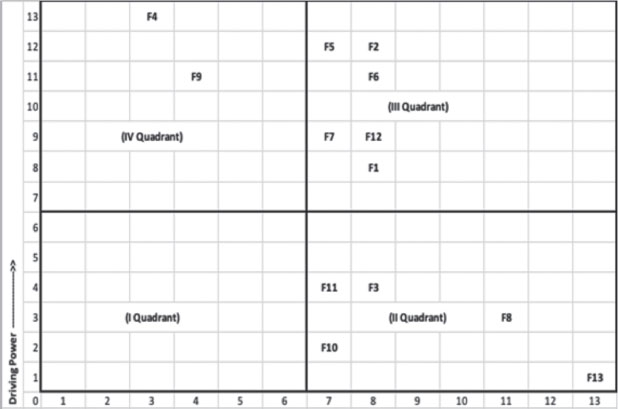

The MICMAC analysis is used to determine the driving and reliance powers. To obtain these values, the FRM was examined, and the accumulation of the rows and columns of the FRM was determined and described in Table 4. Figure 3 depicts the MICMAC plot. The structural analysis of MICMAC generates factor sets (autonomous, dependent, linkage and driver). This is useful in practice as it provides a wealth of information and in-depth insight into the causes and implications of the primary problems associated with blockchain implementation and adoption in FinTech. The four sets consist of:

Figure 3. MICMAC Analysis

1. Autonomous set (I quadrant): A collection of items with a low driving and reliance power (lower left quadrant), but with a negligible system impact. It has less influence on the adoption process. However, no such component was detected in the current investigation.

2. Dependent set (II Quadrant): This set of factors has a low driving force but a strong dependence force (lower right quadrant) and is, therefore, more essential in the model. These variables reflect output-dependent variables throughout the system. Five characteristics were identified: “behavioural intention to use blockchain in FinTech (F13)”, “Trust (F11)”, “Perceived Value (F10)”, “Energy Consumption (F3)”, and "Leadership Readiness (F8)".

3. Linkage set (III Quadrant): provides a lot of driving and dependence power (upper right quadrant). In ISM hierarchical models, it has a lower priority level, and the following factors were found in this category: “Robust and Mature Smart Contract (F9)”, and “Regulations and Law (F4)”. These variables are less stable, and practitioners should observe them at all times. These factors are essential since they are highly dependent on others, and practitioners must nurture the supporting aspects to attain these output factors and enable remarkable development achievement.

4. Independent set (IV Quadrant): This set is the foundation for successful improvement since it has high driving and low dependence power (upper left quadrant). “Scalability (F1)”, “Security (F2)”, “Transaction Traceability (F5)”, “Decentralisation (F6)”, “Privacy/Transparency (F7)” and “Immutability (F12)” are among the factors. Practitioners must evaluate these key driving factors to ensure that they have the least impact on the other aspects.

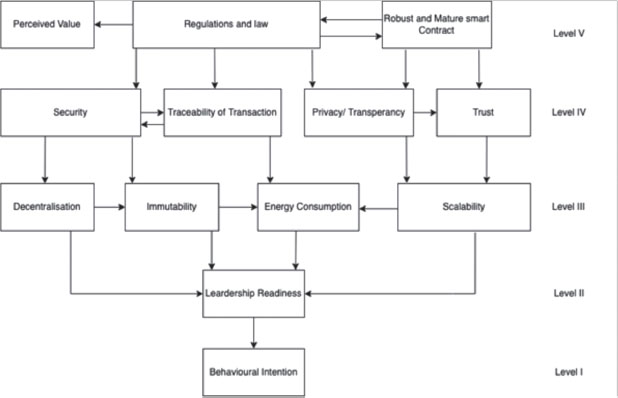

4.5. Development of ISM-based Model

After the MICMAC study, the FRM was utilised to form the ISM model (using nodes/vertices and lines of edges), which is now known as a digraph. The transitivity linkages are deleted, and the ISM model assigns nodes. The model depicts factors at all levels and their links to factors at the same and higher levels.

The levels in Figure 3 are also related to four quadrants of the MICMAC diagram, with the primary driving problems all described in the MICMAC diagram's independent quadrant. These factors have a lot of driving power, and they cause other factors in the model. None of the factors requires a lot of driving and depending on others. This suggests that the problems are not random. The dependent factors are presented in the second quadrant. These issues have a low driving power but a high dependence power. Therefore, they are influenced by interdependent factors with larger driving power. All factors with a high degree of dependence and driving power are presented in the third quadrant. In the ISM model, these factors are generally found between the top and bottom layers of variables. They effectively serve as mediators between the primary driving and dependent factors. All problems with high driving and low dependent power are included in the fourth and final quadrant. These issues mostly affect the bottom half of the ISM model, posing additional factors in the suggested paradigm illustrated in Figure 4.

Figure 4. ISM Based Research Model

5. Discussion and Analysis of ISM based Model

This study depicts the growing demand for blockchain technology and the worldwide trend toward more innovative FinTech transactions. Other variables for blockchain adoption in FinTech tech are “Perceived Value (F10)”, “Regulation and Legislation (F4)”, and “Robust and Mature Smart Contract (F9)”, according to the ISM model shown in Figure 3. This indicates that the price included in implementing blockchain in the financial sector plays a significant role with well-drafted regulations and laws. Implementing blockchain requires a substantial initial cost, whereas new blocks carry certain charges. There is also an increase in smart contracts in daily digital transactions, and the inclusion of intelligent contracts in financial blockchain makes it more robust (Sharma et al., 2021). Testing and deploying blockchain pilots successfully can impact how the technology is embraced and deployed in FinTech.

FinTech was classified into two forms, innovating traditional forms and introducing new forms of technical financial services. So out of the various factors selected for the study, both would help FinTech service providers. The interoperability of blockchain technology should be established with the existing systems and new ventures to ensure the seamless functioning of the new ventures and encourage innovation within the traditional systems. In contrast, blockchain is being integrated with FinTech. The government should frame regulations and laws to validate the implementation of blockchain in the delivery of financial services. The lack of regulations and laws is a serious concern among early and new adopters of blockchain in FinTech. These three factors further lead to "Security (F2)", "Traceability of Transactions (F5)", "Privacy / Transparency (F7)", "Trust (F11)".

These hierarchical relationships make perfect sense as regulations and law could lead to security and traceability of transactions, enhancing privacy and transparency. In contrast, robust and mature smart contracts in financial blockchains can also improve privacy/transparency and trust. Even though blockchain technology provides a highly secure method of exchanging payments via a network, the lack of regulations and laws can cause these relationships to act reversibly. Traditional financial institutions should ensure standard rules and law by the central governing body to implement blockchain in their existing systems to become more secure, transparent, and trustworthy. While executing smart contracts, there is no need for a central authority or third party to support these transactions because they are automatically executed when particular circumstances are met, further enhancing trust among the users.

The factors (i.e., security, traceability of transaction, privacy/ transparency and trust) in blockchain implementation illustrated at level 4 lead to factors at the next level, including "Decentralisation (F6)", "Immutability (F12)", "Energy Consumption (F3)" and "Scalability (F1)". The integration of these factors leads to any primary blockchain. Blockchain can be understood as a decentralised ledger, storing transaction records on multiple computers simultaneously, further enhancing the security and transparency of the data stored on it. Blockchain requires a huge electricity consumption, and abundant energy supplies can require using or adopting blockchain in FinTech. Blockchain becomes voluminous with the ever-increasing number of transactions, so scalability is a concern for blockchain, as every block addition consumes tremendous energy and requires more storage. However, various consensus algorithms such as Proof-of-Stake (PoS), IOTW's Proof-of-Assignment (PoA) Protocol have reduced both, the computational power and the risk of memory loss, making the process much easier.

These four factors further lead to "Leadership Readiness (F8)". According to (Holotiuk et al., 2019) blockchain adoption is hampered by a lack of top-level management skills. Leadership (CEO influence, opinion leadership, and top management support) is identified by several theoretical frameworks as a vital component in adopting innovations (Till et al., 2017). All above levels of factors have an impact on leadership readiness as leadership readiness takes into consideration all the primary level III (F6, F12, F3 and F1), security features level IV (F2, F5, F7 and F11) and regulatory features at level V (F4, F9 and F10) to adopt and implement blockchain in FinTech. On the other hand, these elements represent a mix of problems and benefits for implementing blockchain in FinTech. According to the performed analysis, energy consumption and scalability is on level II of the model, but it is also one of the drawbacks of blockchain usage in Fintech. Blockchain is an energy-intensive new technology, and because financial blockchains grow larger with every single transaction, scalability is also a significant concern. Besides these disadvantages, blockchain has several advantages, i.e., perceived value, security, mature smart contracts, traceability of transactions, privacy/ transparency, trust, decentralisation and immutability. Whereas leadership readiness can be identified as a neutral construct since it is challenging to apply innovative technology for any top management despite the technology's benefits, determining whether or not an institution is prepared to accept that technology is complex.

5.1. Theoretical Contributions

This research makes several theoretical contributions. This is the first study of its kind to compile a diverse collection of factors for blockchain adoption in FinTech and review related literature. Using the ISM-MICMAC technique, this study takes a step ahead in establishing links between various elements. The conceptual framework offers us a plethora of data regarding these issues and defines clear categories for them, making driving and dependant factors easier to comprehend. This would help researcher better grasp the driving factors and the other factors reliant on these drivers if they were classified in this way. Researchers can also use the ISM-based approach to understand factors that have both driving and dependant aspects. This proposed framework clarifies how various factors considered for blockchain adoption in FinTech are linked and interrelated, as depicted in the ISM-based model.

6. Conclusion and Future Work

The study identifies a unique set of factors for implementing blockchain technology in FinTech. This article explores 13 such factors and the projected value of blockchain adoption in FinTech using the ISM-MICMAC-Based technique based on a qualitative research design. According to the findings, factors such as "Price Value (F10)", "Regulations and Law (F4)", and "Robust and Mature Smart Contract (F9)" are the main roadblocks to blockchain implementation in FinTech. Similarly, "Leadership Readiness (F8)" is largely dependent. The findings of the ISM and MICMAC approaches provide a significant knowledge of the hierarchies of various factors and the power that drives and depends on them.

Further on, researchers can also extend ISM-MICMAC with TISM to estimate these key factors. Whereas this research does not classify factors and independent and dependent factors, further research can explore factors with cause-and-effect relationships. Future researchers could operationalise the constructs in the proposed model and assess its validity.

6.1. Implications for Practice and Policy

The implementation of blockchain requires enormous capital investment, as using a new technology requires initial investments for both businesses and consumers, including learning costs linked to getting acquainted with the system in general and the adoption of the technology in particular. However, when it comes to transactions and payments, the cost of blockchain adoption is an investment which gives long-term efficiency benefits. Additionally, blockchain requires a significant amount of electricity, and an abundant energy supply, which may prevent its use or deployment. So, before getting aligned with blockchain technology, the organisation should consider the benefits and limitations of adopting this technology. In terms of energy consumption, blockchain will require high-end computers and abundant energy supplies to make safe and secure transactions and run thousands of calculations per second.

Like bitcoin, other financial blockchains will also require intelligent algorithms to operate reliably every second behind the scenes. Dedicated teams with diverse expertise must ensure blockchain deployments and services perform well. High-level encryption algorithms, the removal of personal identifiers, a mix of passwords and biometric verification, and specific access control can all help make blockchain application safer in FinTech. Clients can use analytics functions to run simple blockchain requests behind the scenes. The procedures are convenient to carry out. Outcomes can be achieved in a matter of minutes. For the effective implementation of blockchain the FinTech sector should also consider the law and regulatory compliance related to this technology for better adoption. Organisations implementing blockchain must train their employees well, to keep up with current advancements in blockchain technology and deal with the rising complexity of this technology over time. This will also assist them in overcoming their apprehensions about using more modern technologies, to improve work productivity.

Funding and Informed

No funding was received.

Author Contribution

Somya Gupta study design performed the experiments and wrote the manuscript; Writing – Review & editing Ganesh Prasad Sahu. All authors have read and agreed to the published version of the manuscript.

Data Availability

The study does not report any data.

Ethical Statement

The manuscript in part or in full has not been submitted or published anywhere.

Conflicts of Interest

The authors declare no conflict of interest.

7. References

Agi, M.A. and Nishant, R., (2017). Understanding influential factors on implementing green supply chain management practices: An interpretive structural modelling analysis. Journal of environmental management, 188, pp.351–363. https://doi.org/10.1016/j.jenvman.2016.11.081

Alketbi, A., Nasir, Q. and Talib, M.A., (2018). Blockchain for government services—Use cases, security benefits and challenges. In 2018 15th Learning and Technology Conference (L&T), 112–119. https://doi.org/10.1109/LT.2018.8368494

Atlam, H. F., Alenezi, A., Alassafi, M. O., & Wills, G., (2018). Blockchain with internet of things: Benefits, challenges, and future directions. International Journal of Intelligent Systems and Applications, 10(6), 40–48. https://doi.org/10.5815/ijisa.2018.06.05

Bernard Marr. (2018a). Blockchain and the internet of things: 4 important benefits of combining these two mega trends.

Bernard Marr. (2018b). The 5 big problems with blockchain everyone should be aware of.

Biais, B., Bisiere, C., Bouvard, M. and Casamatta, C., (2019). The blockchain folk theorem. The Review of Financial Studies, 32(5), 1662–1715. https://doi.org/10.1093/rfs/hhy095

Biswas, B., & Gupta, R. (2019). Analysis of barriers to implement blockchain in industry and service sectors. Computers & Industrial Engineering, 136, 225–241. https://doi.org/10.1016/j.cie.2019.07.005

Casino, F., Dasaklis, T.K. and Patsakis, C., (2019). A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telematics and informatics, 36, 55–81. https://doi.org/10.1016/j.tele.2018.11.006

Chang, V., Baudier, P., Zhang, H., Xu, Q., Zhang, J., & Arami, M., (2020). How Blockchain can impact financial services–The overview, challenges and recommendations from expert interviewees. Technological forecasting and social change, 158, 120-166. https://doi.org/10.1016/j.techfore.2020.120166

Chen, Y., & Bellavitis, C., (2020). Blockchain disruption and decentralized finance: The rise of decentralized business models. Journal of Business Venturing Insights, 13, e00151. https://doi.org/10.1016/j.jbvi.2019.e00151

Chong, A.Y.L., Lim, E.T., Hua, X., Zheng, S. and Tan, C.W., (2019). Business on chain: A comparative case study of five blockchain-inspired business models. Journal of the Association for Information Systems, 1308-1337. https://doi.org/10.17705/1jais.00568

Clauson, K.A., Breeden, E.A., Davidson, C. and Mackey, T.K., (2018). Leveraging Blockchain Technology to Enhance Supply Chain Management in Healthcare: An exploration of challenges and opportunities in the health supply chain. Blockchain in healthcare today. https://doi.org/10.30953/bhty.v1.20

Clohessy, T. and Acton, T., (2019). Investigating the influence of organizational factors on blockchain adoption: An innovation theory perspective. Industrial Management & Data Systems, 119(7), 1457–1491. https://doi.org/10.1108/IMDS-08-2018-0365

Cong, L. W., & He, Z., (2019). Blockchain disruption and smart contracts. The Review of Financial Studies, 32(5), 1754–1797. https://doi.org/10.1093/rfs/hhz007

Crookes, L. and Conway, E., (2018). Technology challenges in accounting and finance. In Contemporary issues in accounting (pp. 61–83). Springer International Publishing. https://doi.org/10.1007/978-3-319-91113-7_4

Feng, Q., He, D., Zeadally, S., Khan, M.K. and Kumar, N., (2019). A survey on privacy protection in blockchain system. Journal of Network and Computer Applications, 126, 45–58. https://doi.org/10.1016/j.jnca.2018.10.020

Fosso Wamba, S., Kala Kamdjoug, J.R., Epie Bawack, R. and Keogh, J.G., (2020). Bitcoin, Blockchain and Fintech: a systematic review and case studies in the supply chain. Production Planning & Control, 31(2–3), 115–142. https://doi.org/10.1080/09537287.2019.1631460

Fridgen, G., Radszuwill, S., Urbach, N. and Utz, L., (2018). Cross-organizational workflow management using blockchain technology: towards applicability, auditability, and automation. In 51st Annual Hawaii International Conference on System Sciences (HICSS).

Gomber, P., Kauffman, R.J., Parker, C. and Weber, B.W., (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of management information systems, 35(1), 220–265. https://doi.org/10.1080/07421222.2018.1440766

Guo, Y. and Liang, C., (2016). Blockchain application and outlook in the banking industry. Financial innovation, 2(1), 24. https://doi.org/10.1186/s40854-016-0034-9

Haleem, A., Luthra, S., Mannan, B., Khurana, S., Kumar, S. and Ahmad, S., (2016). Critical factors for the successful usage of fly ash in roads & bridges and embankments: Analyzing Indian perspective. Resources Policy, 49, 334–348. https://doi.org/10.1016/j.resourpol.2016.07.002

Holotiuk, F., Pisani, F. and Moormann, J., (2019). Radicalness of blockchain: an assessment based on its impact on the payments industry. Technology Analysis & Strategic Management, 31(8), 915–928. https://doi.org/10.1080/09537325.2019.1574341

Ji, F. and Tia, A., (2021). The effect of blockchain on business intelligence efficiency of banks. Kybernetes, 51(8), 2652-2668. https://doi.org/10.1108/K-10-2020-0668

Jonsson, J.R., (2018). Perceived affordance and socio-technical transition: blockchain for the swedish public sector. KTH Royal Institute of Technology School of Industrial Engineering and Management.

Juho Lindman, Virpi Kristiina Tuunainen, & Matti Rossi. (2017). Opportunities and Risks of Blockchain Technologies – A Research Agenda. Hawaii International Conference on System Sciences (HICSS).

Kabir, M.R., (2021). Behavioural intention to adopt blockchain for a transparent and effective taxing system. Journal of Global Operations and Strategic Sourcing, 14(1), 170–201. https://doi.org/10.1108/JGOSS-08-2020-0050

Kamel Boulos, M.N., Wilson, J.T. and Clauson, K.A., (2018). Geospatial blockchain: promises, challenges, and scenarios in health and healthcare. International Journal of Health Geographics, 17(1), 25. https://doi.org/10.1186/s12942-018-0144-x

Lee, D.K.C. and Teo, E.G., (2015). Emergence of FinTech and the LASIC Principles. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2668049

Liu, N. and Ye, Z., (2021). Empirical research on the blockchain adoption–based on TAM. Applied Economics, 53(37), 4263–4275. https://doi.org/10.1080/00036846.2021.1898535

Malin Rosenberg. (2018). Blockchain for the Swedish Fund Market: A comparative study of the blockchain platforms Chain Core and Hyperledger Fabric. Uppsala Universitet.

Marco Iansiti, & Karim R. Lakhani. (2017). The Truth About Blockchain.

Mary C. Lacity, (2018). A Manager's Guide to Blockchains for Business: From Knowing What to Knowing How.

Mathiyazhagan, K., Govindan, K., NoorulHaq, A. and Geng, Y., 2013. An ISM approach for the barrier analysis in implementing green supply chain management. Journal of cleaner production, 47, 283–297. https://doi.org/10.1016/j.jclepro.2012.10.042

Mills, D.C., Wang, K., Malone, B., Ravi, A., Marquardt, J., Badev, A.I., Brezinski, T., Fahy, L., Liao, K., Kargenian, V. and Ellithorpe, M., (2016). Distributed ledger technology in payments, clearing, and settlement. Finance and Economics Discussion Series, 95. https://doi.org/10.17016/FEDS.2016.095

Mishra, L. and Kaushik, V., (2021). Application of blockchain in dealing with sustainability issues and challenges of financial sector. Journal of Sustainable Finance & Investment, 1–16. https://doi.org/10.1080/20430795.2021.1940805

Niranjanamurthy, M., Nithya, B.N. and Jagannatha, S.J.C.C., (2019). Analysis of Blockchain technology: pros, cons and SWOT. Cluster Computing, 22(6), 14743–14757. https://doi.org/10.1007/s10586-018-2387-5

Pereira, J., Tavalaei, M.M. and Ozalp, H., (2019). Blockchain-based platforms: Decentralized infrastructures and its boundary conditions. Technological Forecasting and Social Change, 146, 94–102. https://doi.org/10.1016/j.techfore.2019.04.030

Prasad, S., Shankar, R., Gupta, R. and Roy, S., (2018). A TISM modeling of critical success factors of blockchain based cloud services. Journal of Advances in Management Research, 15(4), 434–456. https://doi.org/10.1108/JAMR-03-2018-0027

Rana, N.P., Dwivedi, Y.K. and Hughes, D.L., (2022). Analysis of challenges for blockchain adoption within the Indian public sector: An interpretive structural modelling approach. Information Technology & People, 35(2), 548–576. https://doi.org/10.1108/ITP-07-2020-0460

Reyna, A., Martín, C., Chen, J., Soler, E. and Díaz, M., (2018). On blockchain and its integration with IoT. Challenges and opportunities. Future generation computer systems, 88, 173–190. https://doi.org/10.1016/j.future.2018.05.046

Samad, T. A., Sharma, R., Ganguly, K. K., Wamba, S. F., & Jain, G., (2022). Enablers to the adoption of blockchain technology in logistics supply chains: evidence from an emerging economy. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04546-1

Sawant, B.S., (2011). Technological developments in Indian banking sector. Indian Streams Research Journal.

Shardeo, V., Patil, A., & Madaan, J. (2020). Critical Success Factors for Blockchain Technology Adoption in Freight Transportation Using Fuzzy ANP-Modified TISM Approach. International Journal of Information Technology and Decision Making, 19(6), 1549–1580. https://doi.org/10.1142/S0219622020500376

Sharma, M., Sehrawat, R., Daim, T., & Shaygan, A., (2021). Technology assessment: Enabling Blockchain in hospitality and tourism sectors. Technological Forecasting and Social Change, 169, 120810. https://doi.org/10.1016/j.techfore.2021.120810

Shin, D.D.H., (2019). Blockchain: The emerging technology of digital trust. Telematics and informatics, 45, 101278. https://doi.org/10.1016/j.tele.2019.101278

Stewart, H. and Jürjens, J., (2017). Information security management and the human aspect in organizations. Information & Computer Security, 25(5), 494–534. https://doi.org/10.1108/ICS-07-2016-0054

Tang, C. S., & Veelenturf, L. P. (2019). The strategic role of logistics in the industry 4.0 era. Transportation Research Part E: Logistics and Transportation Review, 129, 1–11. https://doi.org/10.1016/j.tre.2019.06.004

Tapscott, D., & Tapscott, A., (2017). How Blockchain Will Change Organizations. MIT Sloan Management Review, 58(2), 10–13. https://www.proquest.com/scholarly-journals/how-blockchain-will-changeorganizations/ docview/1875399260/se-2?accountid=27544

Till, B. M., Peters, A. W., Afshar, S., & Meara, J. G., (2017). From blockchain technology to global health equity: can cryptocurrencies finance universal health coverage?. BMJ global health, 2(4), e000570. https://doi.org/10.1136/bmjgh-2017-000570

Toufaily, E., Zalan, T., & Dhaou, S. B., (2021). A framework of blockchain technology adoption: An investigation of challenges and expected value. Information & Management, 58(3), 103444. https://doi.org/10.1016/j.im.2021.103444

Truby, J., (2018). Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies. Energy research & social science, 44, 399–410. https://doi.org/10.1016/j.erss.2018.06.009

Xu, Y., Chong, H. Y., & Chi, M., (2021). Modelling the blockchain adoption barriers in the AEC industry. Engineering, Construction and Architectural Management. https://doi.org/10.1108/ECAM-04-2021-0335

Yadav, A. S., Agrawal, S., & Kushwaha, D. S. (2022). Distributed Ledger Technology-based land transaction system with trusted nodes consensus mechanism. Journal of King Saud University-Computer and Information Sciences, 34(8), 6414–6424. https://doi.org/10.1016/j.jksuci.2021.02.002

Yadav, A.S. and Kushwaha, D.S., (2021). Blockchain-based digitization of land record through trust value-based consensus algorithm. Peer-to-Peer networking and applications, 14(6), 3540–3558. https://doi.org/10.1007/s12083-021-01207-1

Yadav, A. S., & Kushwaha, D. S. (2022). Digitization of land record through blockchain-based consensus algorithm. IETE Technical Review, 39(4), 799–816. https://doi.org/10.1080/02564602.2021.1908859

Yadav, A.S., Singh, N. and Kushwaha, D.S., (2022). A scalable trust based consensus mechanism for secure and tamper free property transaction mechanism using DLT. International Journal of System Assurance Engineering and Management, 13(2), 735–751. https://doi.org/10.1007/s13198-021-01335-0

Yadav, A. S., Singh, N., & Kushwaha, D. S. (2022). Sidechain: storage land registry data using blockchain improve performance of search records. Cluster Computing, 25(2), 1475–1495. https://doi.org/10.1007/s10586-022-03535-0

Zheng, Z., Xie, S., Dai, H. N., Chen, X., & Wang, H., (2018). Blockchain challenges and opportunities: A survey. International Journal of Web and Grid Services, 14(4), 352. https://doi.org/10.1504/IJWGS.2018.095647